Nassim Nicholas Taleb Uncertainty Series in Four Parts

My own thoughts on the future - how to benefit from uncertainty

2021 Words to myself

- Risk-sharing

- think rationally

- Love random volatility

- Do unto others as you would have them do unto you

2021 A New Beginning

I recently spent three months on my own reading the four-part series of uncertainty books by Nassim Nicholas Taleb.

The overall summary of the feelings after reading is that, just right to make myself from deep inside out to find how to enhance their own anti-vulnerability through the judgment of randomness, correct my previous misunderstanding of the concept of investment, because many colleagues around me want financial freedom, then the question is how you want to approach this freedom, through the short-term constant speculation, speculation in digital currency If you look at the asymmetric risk, you will definitely end up with a 100% loss in it.

After this blog, I need to document the key ideas and sentences from these four books in the next blog.

The most important point about investing is: Less talk, put yourself at risk, Improve your perception, Be able to distinguish what is random noise and what is beneficial volatility, Stop discussing and risk-related content and think independently and judge for yourself.

2021 I also hope to expand my cognition through continuous learning so as to achieve the small goal of financial freedom.

The next three books I will study are:

-

Fractal Geometry and Dynamical Systems Lecture Notes

-

Chaos and Fractals - The New Frontier of Science.

-

Advances in financial machine learning

Fractal and chaos theory mainly goes to understand the whole financial system because of some unpredictable small actions that finally lead to the paralysis of the whole financial system. The most typical example of this is the slow formation of a hurricane caused by a butterfly flapping its wings. Another example is the current global COVID-19 pandemic, in which the United States and other countries around the world have been continuously issuing more money to the market, a move that could accelerate the rate of currency devaluation for the financial system in the future.

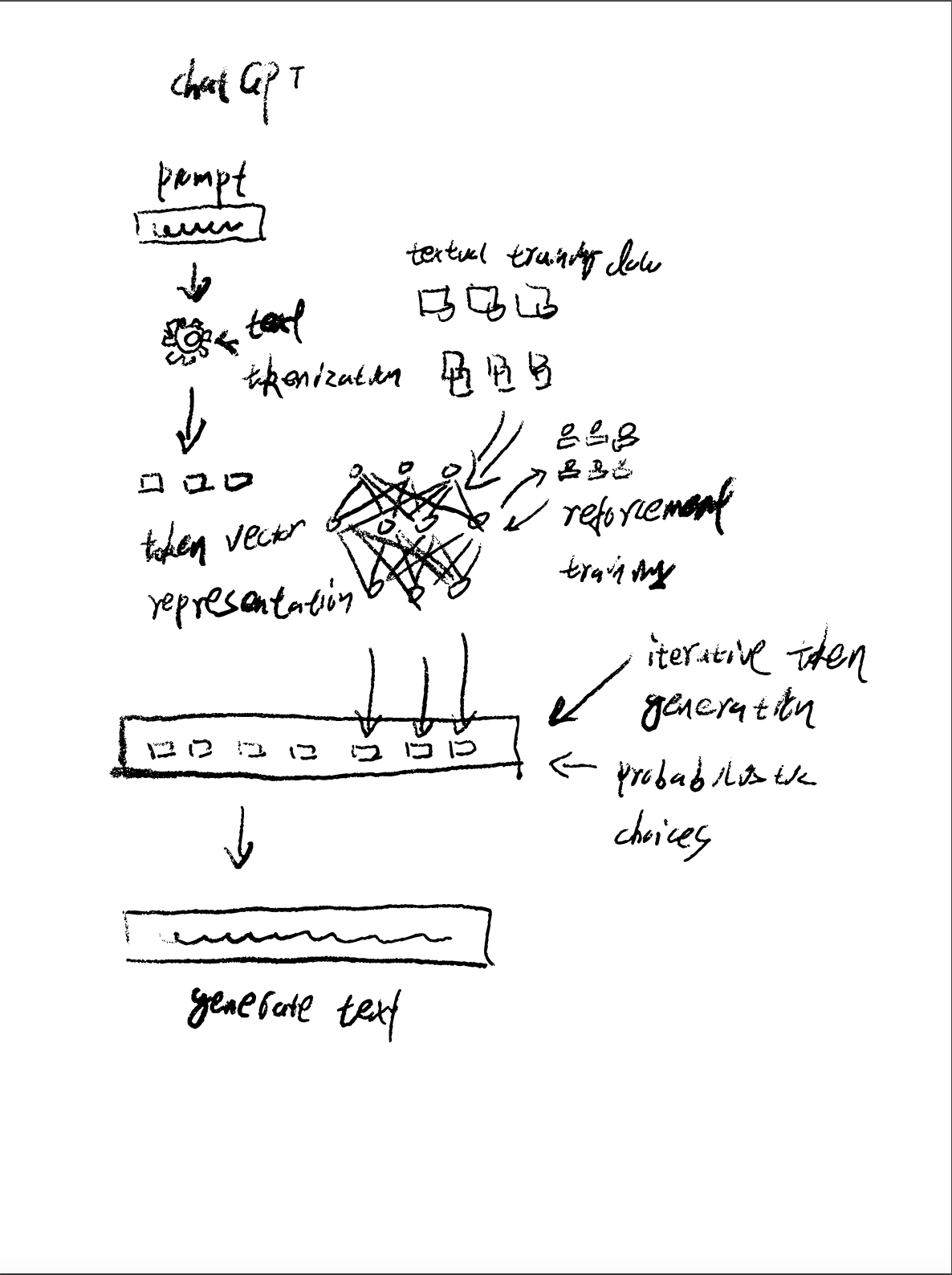

The last book focuses on analyzing and predicting financial markets through machine learning.

That’s it for today - good night!